Understanding Capital Gains Tax

What do you mean by Capital Gains Tax?

Capital gains tax is a tax imposed on the profit earned from the sale of assets such as stocks, real estate, and other investments. It is important to understand that not all assets are subject to capital gains tax, and the tax rate can vary depending on the type of asset and how long it was held before being sold.

How does Capital Gains Tax work?

When you sell an asset for a profit, the difference between the purchase price and the selling price is considered a capital gain. This gain is then taxed based on the applicable capital gains tax rate. The tax is only due when the asset is sold, and the amount of tax owed is determined by the length of time the asset was held and the tax rate applicable to that asset.

What is known about Capital Gains Tax?

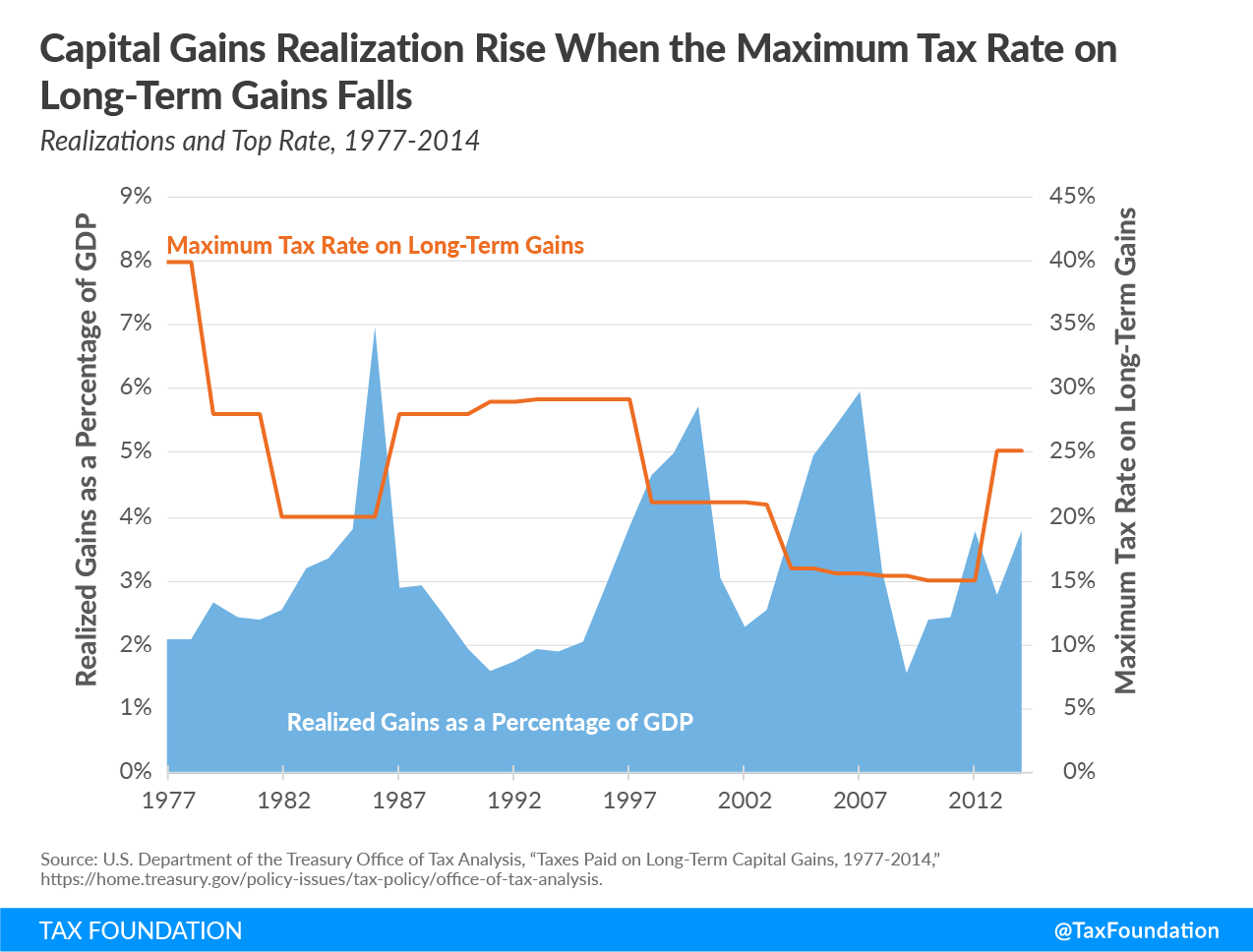

Image Source: taxfoundation.org

Capital gains tax is typically levied at a lower rate than ordinary income tax, with the idea being to encourage investment and economic growth. The tax rate can vary depending on the asset and the length of time it was held. Short-term capital gains, which are gains on assets held for one year or less, are taxed at a higher rate than long-term capital gains, which are gains on assets held for more than one year.

How to minimize Capital Gains Tax?

There are several strategies that can be employed to minimize capital gains tax. One common strategy is to hold onto assets for more than one year to qualify for the lower long-term capital gains tax rate. Another strategy is to offset capital gains with capital losses, which can reduce or eliminate the tax owed on gains. Additionally, taking advantage of tax-deferred accounts such as retirement accounts can help to delay or avoid capital gains tax altogether.

Information about Capital Gains Tax

It is important to note that not all assets are subject to capital gains tax. For example, the sale of a primary residence may be exempt from capital gains tax up to a certain threshold. Additionally, certain types of investments such as municipal bonds may be exempt from capital gains tax altogether. It is important to consult with a tax professional to understand the specific tax implications of your investments and assets.

Solution to Capital Gains Tax issues

One way to address the issue of capital gains tax is to engage in tax planning strategies that can help to minimize the tax owed on gains. This can include carefully timing the sale of assets to take advantage of lower tax rates, offsetting gains with losses, and utilizing tax-deferred accounts to delay or avoid tax altogether. It is also important to stay informed about changes in tax laws that may impact capital gains tax rates and exemptions.

Conclusion

In conclusion, capital gains tax is a tax imposed on the profit earned from the sale of assets. Understanding how capital gains tax works, the different tax rates applicable to various assets, and strategies to minimize tax owed can help individuals make informed decisions about their investments and financial planning. Consulting with a tax professional can provide valuable guidance on how to navigate the complexities of capital gains tax and optimize tax efficiency.

FAQs about Capital Gains Tax

1. What assets are subject to capital gains tax?

Assets such as stocks, real estate, and other investments are subject to capital gains tax when sold for a profit.

2. Are there any exemptions to capital gains tax?

Certain assets, such as primary residences and municipal bonds, may be exempt from capital gains tax up to certain thresholds.

3. How can I minimize capital gains tax?

Strategies such as holding onto assets for more than one year, offsetting gains with losses, and utilizing tax-deferred accounts can help to minimize capital gains tax.

4. What is the difference between short-term and long-term capital gains?

Short-term capital gains are gains on assets held for one year or less and are taxed at a higher rate than long-term capital gains, which are gains on assets held for more than one year.

5. Why is it important to consult with a tax professional about capital gains tax?

Tax laws regarding capital gains tax can be complex and subject to change. A tax professional can provide valuable guidance on how to minimize tax owed and optimize tax efficiency.

Capital gains tax