Understanding Long-Term Care Insurance

What is Long-Term Care Insurance?

Long-term care insurance is a type of insurance policy that provides coverage for medical and personal care services for individuals who are unable to perform basic activities of daily living due to a chronic illness, disability, or cognitive impairment. These services may include assistance with bathing, dressing, eating, and medication management. Long-term care insurance is designed to help individuals cover the cost of long-term care services, which can be expensive and often not covered by other types of insurance.

How Does Long-Term Care Insurance Work?

When an individual purchases a long-term care insurance policy, they pay a premium to the insurance company in exchange for coverage for long-term care services. If the policyholder requires long-term care services in the future, the insurance company will pay for a portion of the cost of those services, up to the limits specified in the policy. The policyholder may be required to pay a deductible or co-payment before the insurance company will begin covering the cost of care.

What is Covered by Long-Term Care Insurance?

Image Source: ramseysolutions.net

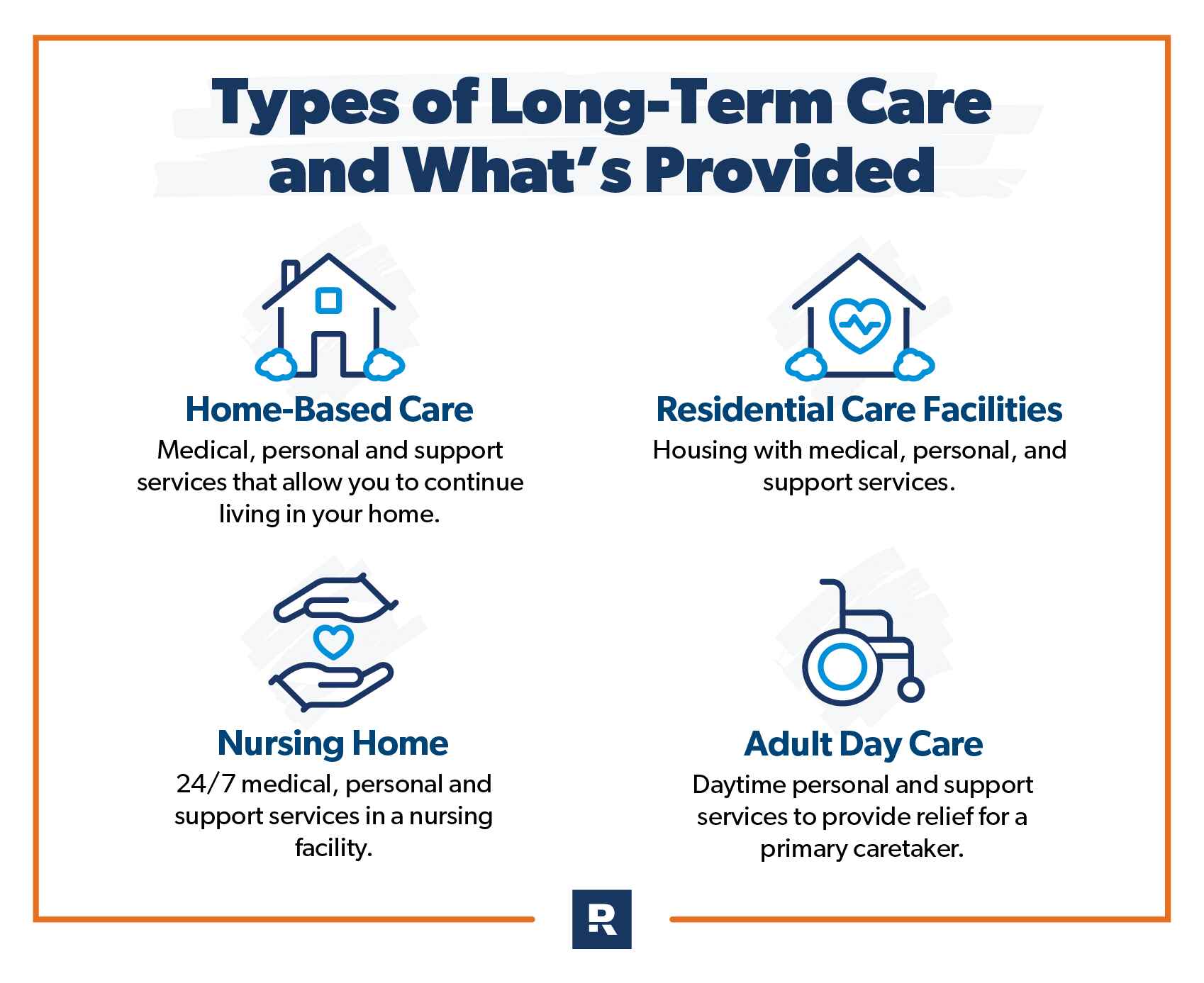

Long-term care insurance typically covers a range of services, including nursing home care, assisted living facilities, in-home care, and adult day care services. Some policies may also cover services such as physical therapy, occupational therapy, and speech therapy. The specific services covered will vary depending on the policy and the insurance company.

What is Not Covered by Long-Term Care Insurance?

While long-term care insurance can help cover the cost of many long-term care services, there are some services that are typically not covered by these policies. These may include services that are not medically necessary, such as cosmetic surgery, and services that are provided by family members or friends without charge. It is important to carefully review the terms of the policy to understand what is and is not covered.

What Are the Benefits of Long-Term Care Insurance?

One of the primary benefits of long-term care insurance is that it can help protect individuals and their families from the financial burden of long-term care services. Long-term care can be expensive, and without insurance coverage, individuals may be forced to pay for these services out of pocket, depleting their savings and assets. Long-term care insurance can provide peace of mind knowing that one’s long-term care needs will be covered.

How to Choose a Long-Term Care Insurance Policy?

When choosing a long-term care insurance policy, it is important to consider several factors, including the cost of the premium, the coverage limits, the services covered, and the reputation of the insurance company. It is also important to consider the individual’s health and financial situation, as well as any family history of long-term care needs. Working with a knowledgeable insurance agent or financial advisor can help individuals make an informed decision about which policy is right for them.

Conclusion

Long-term care insurance can provide valuable financial protection for individuals who may require long-term care services in the future. By understanding how long-term care insurance works, what is covered, and how to choose a policy, individuals can make informed decisions about their long-term care needs and protect themselves from the high cost of long-term care services.

Frequently Asked Questions

1. Is long-term care insurance worth it?

Long-term care insurance can be worth it for individuals who want to protect their assets and savings from the high cost of long-term care services. It can provide peace of mind knowing that long-term care needs will be covered.

2. When should I purchase long-term care insurance?

It is generally recommended to purchase long-term care insurance in your 50s or early 60s, when premiums are lower and eligibility is easier to obtain. Waiting until older age may result in higher premiums or difficulty in finding coverage.

3. What factors should I consider when choosing a long-term care insurance policy?

When choosing a long-term care insurance policy, consider factors such as the cost of the premium, coverage limits, services covered, reputation of the insurance company, and your health and financial situation.

4. Can I use long-term care insurance to cover home care services?

Yes, many long-term care insurance policies cover home care services, including assistance with activities of daily living, medication management, and therapy services. Check the policy details to confirm coverage.

5. Are there alternatives to long-term care insurance?

There are alternative options to long-term care insurance, such as self-insuring, purchasing a life insurance policy with long-term care benefits, or relying on government programs like Medicaid. It is important to explore all options and choose the best solution for your long-term care needs.

Long-term care insurance