Budgeting Tools: A Comprehensive Guide

What do you mean by Budgeting Tools?

Budgeting tools are software applications or online platforms that help individuals and businesses manage their finances by creating and tracking budgets. These tools provide users with insights into their spending habits, income, and expenses, allowing them to make informed financial decisions.

How do Budgeting Tools work?

Budgeting tools work by aggregating financial data from various sources, such as bank accounts, credit cards, and investments. Users can categorize their expenses, set budget goals, and track their progress in real-time. Some tools also offer features like bill reminders, debt payoff calculators, and investment tracking to help users stay on top of their financial goals.

What is known about Budgeting Tools?

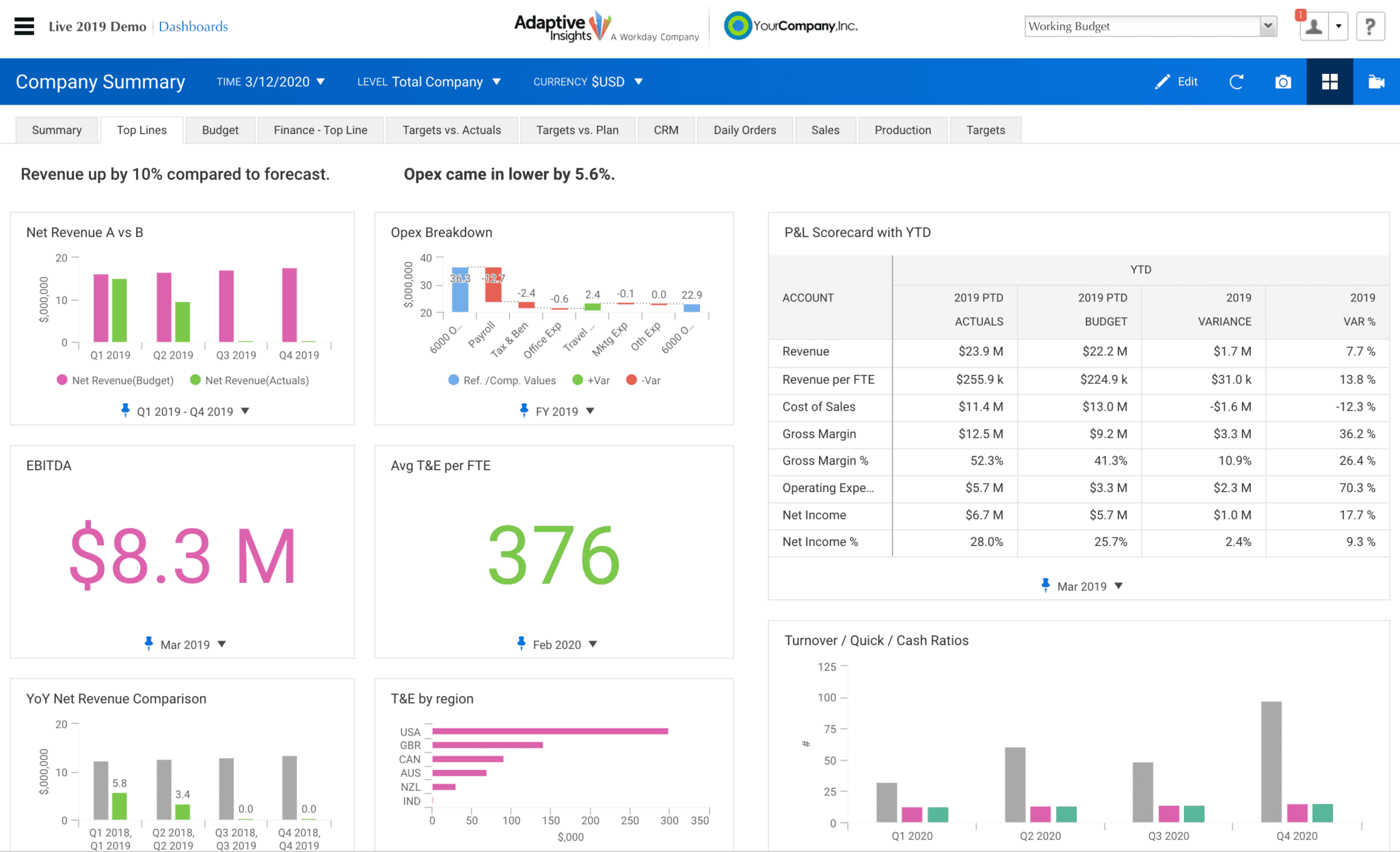

Image Source: spendesk.com

There are several types of budgeting tools available in the market, ranging from simple spreadsheet templates to sophisticated financial management platforms. Some popular budgeting tools include Mint, YNAB (You Need a Budget), Personal Capital, and Quicken. These tools offer a range of features and pricing options to cater to different financial needs and preferences.

Solution provided by Budgeting Tools

By using budgeting tools, individuals and businesses can gain better control over their finances and make smarter financial decisions. These tools help users track their spending, identify areas where they can save money, and plan for future expenses or investments. Budgeting tools also provide valuable insights into financial trends and patterns, allowing users to adjust their budgets accordingly.

Information about Budgeting Tools

Budgeting tools typically offer a range of features to help users manage their finances effectively. Some common features include budget tracking, expense categorization, goal setting, bill reminders, credit score monitoring, and investment tracking. Users can access these tools on their computers, smartphones, or tablets, making it easy to stay on top of their finances no matter where they are.

Benefits of using Budgeting Tools

There are several benefits to using budgeting tools. Firstly, these tools help individuals and businesses gain better insight into their financial health by providing a comprehensive view of their income and expenses. Secondly, budgeting tools help users set and track financial goals, such as saving for a vacation, paying off debt, or building an emergency fund. Thirdly, budgeting tools can help users identify spending patterns and areas where they can cut back on expenses, ultimately leading to better financial outcomes.

Best Practices for using Budgeting Tools

When using budgeting tools, it’s important to regularly update your financial information to ensure that your budget is accurate and up-to-date. It’s also a good idea to review your budget regularly and make adjustments as needed to stay on track with your financial goals. Additionally, it’s helpful to take advantage of the features offered by budgeting tools, such as setting up alerts for overspending, categorizing expenses, and tracking your progress towards your financial goals.

Conclusion

In conclusion, budgeting tools are valuable resources for individuals and businesses looking to improve their financial health and make informed financial decisions. By using these tools, users can gain better insight into their spending habits, track their progress towards financial goals, and make adjustments as needed to achieve financial success. Whether you’re looking to save money, pay off debt, or plan for the future, budgeting tools can help you take control of your finances and build a solid financial foundation.

Frequently Asked Questions about Budgeting Tools

1. Are budgeting tools secure to use?

Yes, most budgeting tools use encryption and other security measures to protect users’ financial information. It’s important to choose a reputable budgeting tool with a track record of data security.

2. Can I use budgeting tools for my business?

Yes, many budgeting tools offer features specifically designed for businesses, such as expense tracking, invoicing, and profit and loss reporting. Be sure to choose a budgeting tool that meets the financial needs of your business.

3. Are budgeting tools expensive to use?

Not necessarily. There are many free budgeting tools available, as well as affordable paid options with additional features. It’s important to consider your budget and financial goals when choosing a budgeting tool.

4. How often should I update my budgeting tool?

It’s a good idea to update your budgeting tool at least once a week to ensure that your financial information is accurate and up-to-date. Regularly reviewing and updating your budget can help you stay on track with your financial goals.

5. Can I access my budgeting tool on multiple devices?

Yes, many budgeting tools offer mobile apps and web platforms that allow users to access their financial information on multiple devices. This makes it easy to manage your finances on the go and stay organized no matter where you are.

Budgeting tools