Financial Coaching Services: Transforming Your Relationship with Money

What do you mean by financial coaching services?

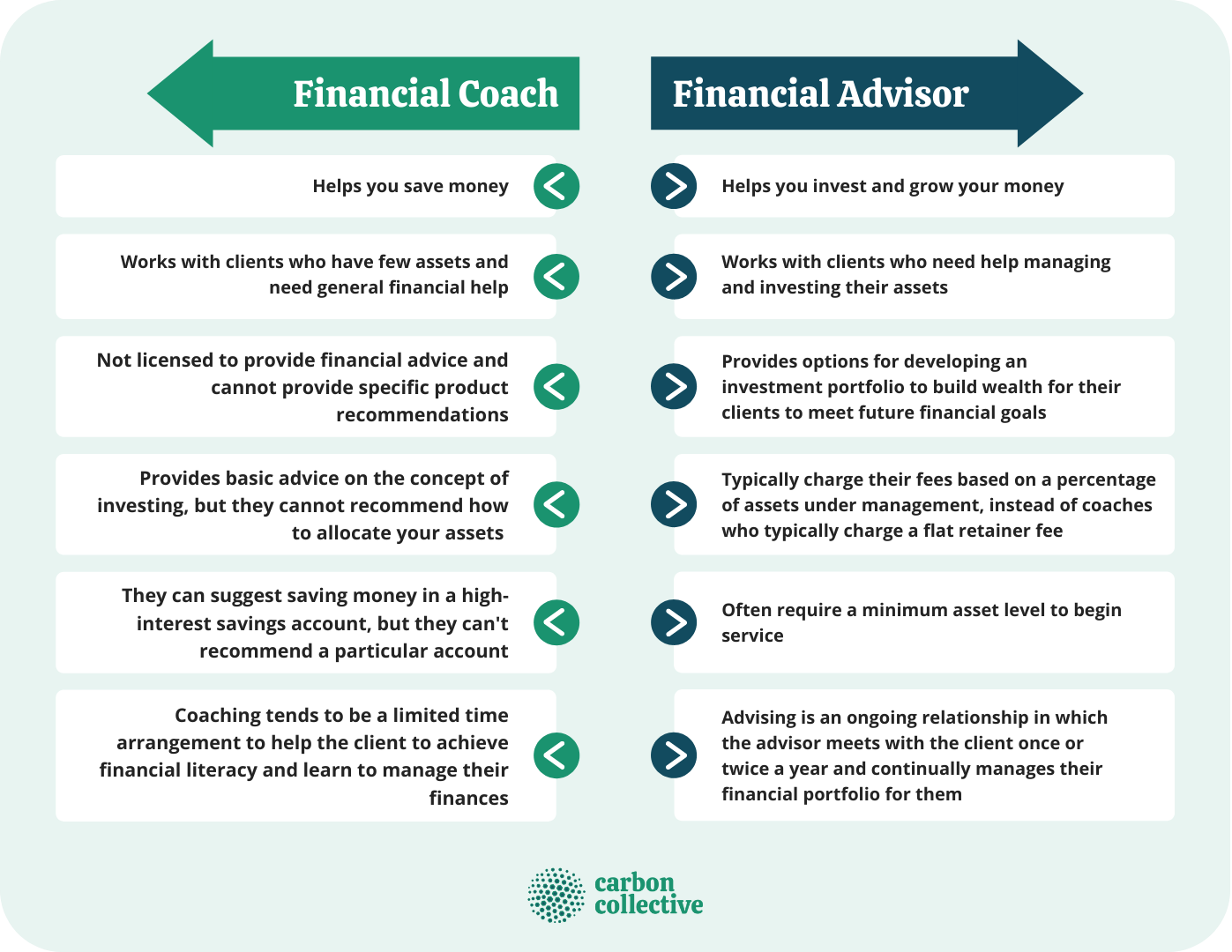

Financial coaching services are a type of professional guidance that helps individuals and families navigate their financial goals and challenges. A financial coach works with clients to create a personalized financial plan, set goals, and develop strategies to achieve those goals. Unlike traditional financial advisors, who typically focus on investments and retirement planning, financial coaches take a holistic approach to money management, addressing both the practical and emotional aspects of financial decision-making.

How do financial coaching services work?

Financial coaching services typically begin with an initial consultation, where the coach and client discuss the client’s financial situation, goals, and challenges. From there, the coach works with the client to create a customized financial plan that addresses key areas such as budgeting, debt management, saving and investing, and goal setting. The coach then provides ongoing support and accountability to help the client stay on track and make progress towards their financial goals.

What is known about financial coaching services?

Financial coaching services have gained popularity in recent years as more people seek help with managing their money and building financial security. Research has shown that financial coaching can be an effective tool for improving financial behaviors and outcomes. A study conducted by the Consumer Financial Protection Bureau found that clients who received financial coaching were more likely to pay off debt, increase savings, and improve their credit scores compared to those who did not receive coaching.

Solution for financial coaching services

Financial coaching services offer a solution for individuals and families who want to take control of their finances and build a secure financial future. By working with a financial coach, clients can gain the knowledge, skills, and confidence they need to make smart financial decisions and achieve their goals. Whether you’re looking to get out of debt, save for a major purchase, or plan for retirement, financial coaching services can help you get on the right track and stay there.

Information about financial coaching services

Financial coaching services are provided by a wide range of professionals, including certified financial coaches, financial therapists, and financial planners. Coaches may work independently or as part of a larger financial planning firm. Many coaches offer their services in person, over the phone, or online, making it easy for clients to access the support they need from anywhere. Fees for financial coaching services vary depending on the provider and the level of service offered, but many coaches offer affordable options for clients at all income levels.

Conclusion

Image Source: carboncollective.co

Financial coaching services can be a valuable resource for anyone looking to improve their financial situation and build a secure future. By working with a financial coach, you can gain the knowledge, skills, and support you need to make smart financial decisions and achieve your goals. Whether you’re struggling with debt, trying to save for a major purchase, or planning for retirement, a financial coach can help you create a plan that works for you and stay on track to financial success.

FAQs

1. What qualifications do financial coaches have?

Financial coaches may have a variety of backgrounds and certifications, including training in financial planning, counseling, or coaching. Look for a coach who is certified by a reputable organization and has experience working with clients in similar situations to yours.

2. How long does it take to see results from financial coaching services?

The timeline for seeing results from financial coaching services can vary depending on your goals and financial situation. Some clients may see improvements in their finances within a few months, while others may take longer to see significant changes. Consistent effort and commitment to the coaching process are key to achieving lasting results.

3. Can financial coaching services help me with specific financial goals?

Yes, financial coaching services can be tailored to help you achieve specific financial goals, such as getting out of debt, saving for a major purchase, or planning for retirement. Your financial coach will work with you to create a customized plan that addresses your unique needs and priorities.

4. How much do financial coaching services typically cost?

The cost of financial coaching services can vary depending on the provider and the level of service offered. Some coaches charge an hourly rate, while others may offer package deals or subscription options. Many coaches also offer sliding scale fees or discounts for clients with limited financial resources.

5. How can I find a reputable financial coach?

To find a reputable financial coach, start by asking for recommendations from friends, family, or colleagues who have used financial coaching services. You can also search online for certified financial coaches in your area or look for reviews and testimonials from past clients. Be sure to interview potential coaches to ensure they have the qualifications and experience to meet your needs.

Financial coaching services