Business Tax Preparation: Everything You Need to Know

What is Business Tax Preparation?

Business tax preparation is the process of organizing and filing tax returns for a business entity. This includes calculating the amount of taxes owed, ensuring compliance with tax laws and regulations, and maximizing deductions and credits to minimize tax liability. Proper tax preparation is essential for businesses of all sizes to avoid penalties, audits, and financial losses.

How Important is Business Tax Preparation?

Business tax preparation is crucial for the financial health and success of a business. Filing taxes inaccurately or late can result in hefty fines, penalties, and even legal consequences. By staying on top of tax obligations and taking advantage of tax-saving strategies, businesses can optimize their financial resources and avoid unnecessary costs.

What is Known About Business Tax Preparation?

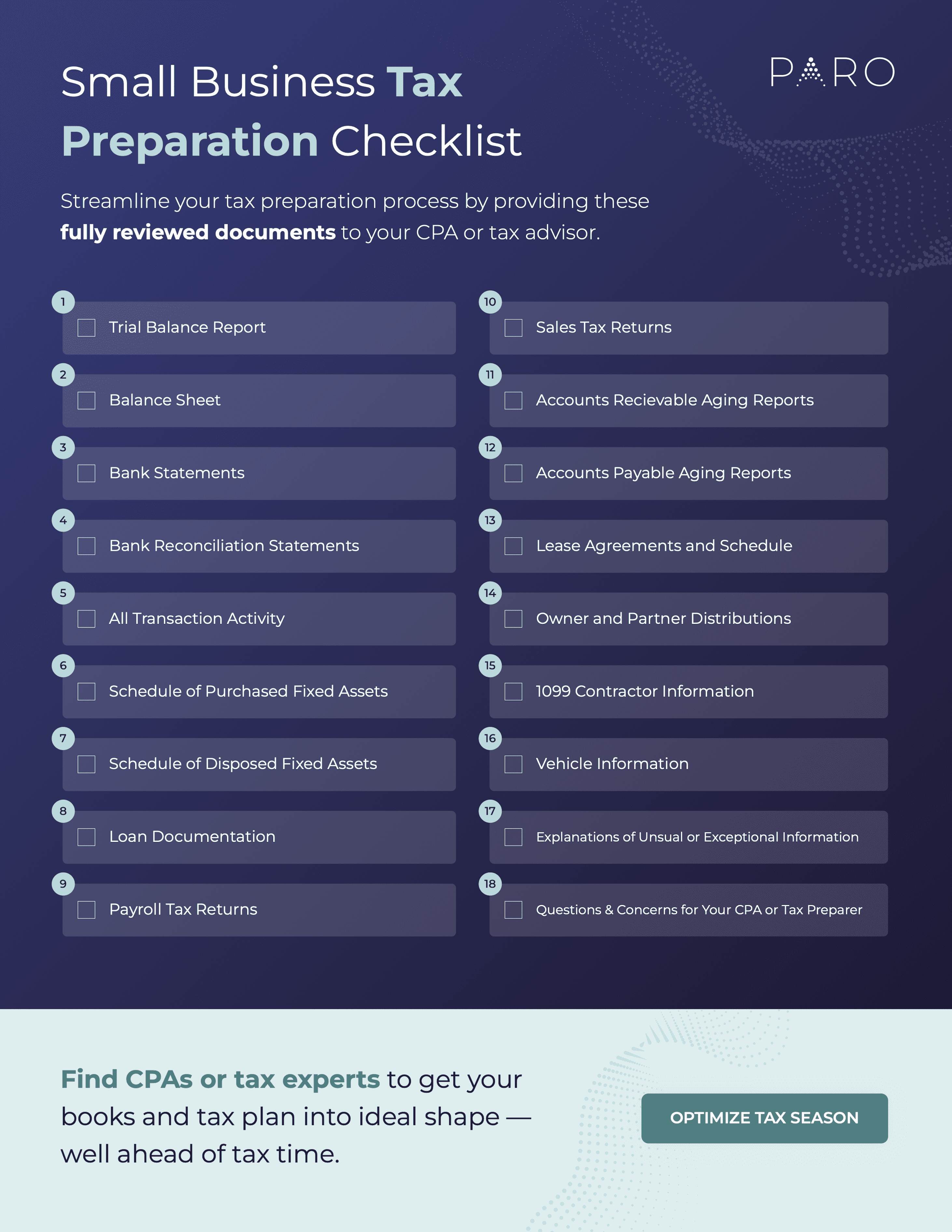

Image Source: paro.ai

Business tax preparation involves a range of tasks, including collecting financial records, organizing expenses, calculating profits and losses, and completing and submitting tax forms. It requires a deep understanding of tax laws and regulations, as well as attention to detail and accuracy in calculations. Many businesses choose to outsource their tax preparation to professional accountants or tax preparers to ensure compliance and maximize tax savings.

Solution for Business Tax Preparation

One solution for businesses looking to streamline their tax preparation process is to invest in tax preparation software. These tools can help automate calculations, organize financial data, and generate reports for filing taxes. Additionally, working with a professional tax preparer or accountant can provide expert guidance and ensure accuracy in tax filings.

Information on Business Tax Preparation

Business tax preparation involves several key steps, including gathering financial documents such as income statements, expense receipts, and payroll records. Businesses must also calculate their taxable income, deductions, and credits to determine their tax liability. Finally, they must complete and submit the necessary tax forms to the IRS or other tax authorities.

FAQs About Business Tax Preparation

1. Why is business tax preparation important?

Business tax preparation is important for ensuring compliance with tax laws and regulations, minimizing tax liability, and avoiding penalties and audits.

2. How can businesses streamline their tax preparation process?

Businesses can streamline their tax preparation process by investing in tax preparation software, working with professional tax preparers, and staying organized with financial records.

3. What are some common mistakes to avoid in business tax preparation?

Common mistakes to avoid in business tax preparation include inaccuracies in financial data, missing deadlines for filing taxes, and failing to take advantage of available tax deductions and credits.

4. When is the deadline for filing business taxes?

The deadline for filing business taxes varies depending on the type of business entity and the tax year. It is important to stay informed about tax deadlines and extensions to avoid penalties for late filing.

5. How can businesses ensure they are in compliance with tax laws?

Businesses can ensure compliance with tax laws by staying informed about changes in tax regulations, keeping accurate financial records, and seeking professional advice from tax experts.

Business tax preparation