Real Estate Crowdfunding: A New Way to Invest in Property

What is Real Estate Crowdfunding?

Real estate crowdfunding is a relatively new concept in the world of investing. It involves pooling together funds from multiple investors to invest in real estate projects. This allows individual investors to participate in real estate deals that were previously only accessible to large institutions or wealthy individuals.

How Does Real Estate Crowdfunding Work?

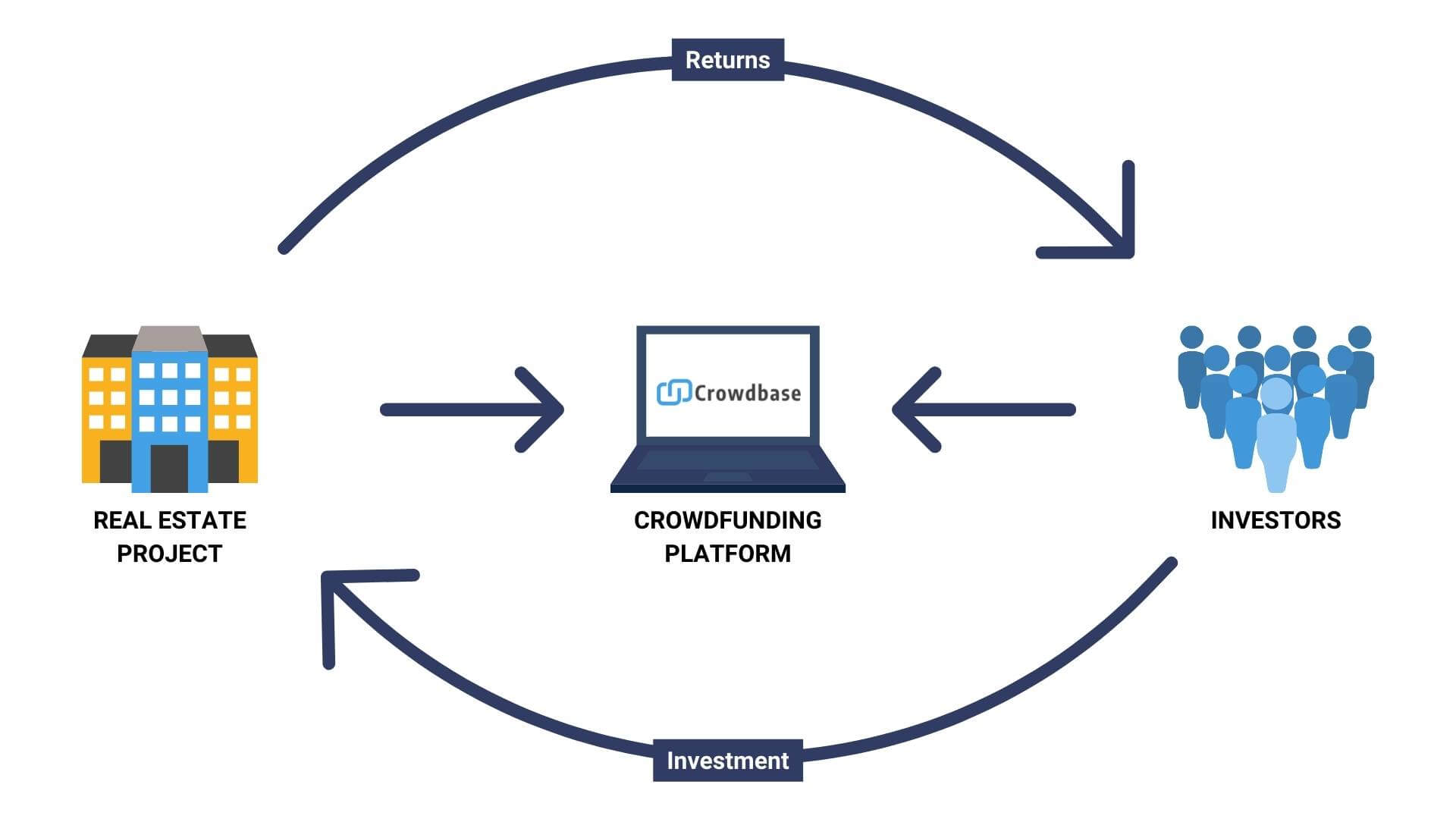

In a real estate crowdfunding project, a sponsor or developer will identify a property or project that requires funding. They will then create a crowdfunding campaign on a platform that connects investors with opportunities. Investors can browse through different projects, review the details, and decide how much they want to invest. Once the funding goal is reached, the project moves forward, and investors receive a return on their investment.

What is Known About Real Estate Crowdfunding?

Image Source: crowdbase.eu

Real estate crowdfunding has gained popularity in recent years due to its accessibility and potential for high returns. It allows investors to diversify their portfolios and invest in real estate without the need for a large amount of capital. Additionally, crowdfunding platforms provide transparency and information about each project, making it easier for investors to make informed decisions.

Solution Provided by Real Estate Crowdfunding

Real estate crowdfunding provides a solution for investors who want to add real estate to their investment portfolios but may not have the resources to purchase properties outright. It also allows developers to access funding for their projects without relying on traditional sources such as banks or institutional investors. Crowdfunding platforms serve as intermediaries that facilitate the process and ensure that both investors and developers are protected.

Information on Real Estate Crowdfunding

When investing in real estate crowdfunding, it is essential to conduct thorough research on the platform, the sponsor, and the specific project. Investors should consider factors such as the location of the property, the potential returns, the risks involved, and the track record of the sponsor. It is also important to understand the terms of the investment, including the expected timeline, potential returns, and any fees or expenses.

Benefits of Real Estate Crowdfunding

There are several benefits to investing in real estate crowdfunding. One of the main advantages is the ability to diversify your investment portfolio without the need for a large amount of capital. Additionally, crowdfunding platforms provide access to a wide range of real estate projects, allowing investors to choose opportunities that align with their investment goals and risk tolerance. Real estate crowdfunding also offers the potential for high returns, as property values and rental incomes can appreciate over time.

Risks of Real Estate Crowdfunding

While real estate crowdfunding can be a lucrative investment opportunity, it also comes with risks. Investors may face the risk of project delays, cost overruns, or potential market fluctuations that could affect the value of the property. Additionally, some crowdfunding platforms may not have adequate due diligence processes in place, leading to a higher risk of fraud or project failure. It is essential for investors to carefully review all information provided by the platform and conduct their own due diligence before making an investment.

Conclusion

Real estate crowdfunding offers a new way for investors to participate in real estate projects and earn returns on their investment. By pooling together funds from multiple investors, crowdfunding platforms provide access to opportunities that were previously reserved for large institutions or wealthy individuals. While there are risks involved, the potential for high returns and portfolio diversification make real estate crowdfunding an attractive option for investors looking to add real estate to their investment portfolios.

FAQs About Real Estate Crowdfunding

1. Is real estate crowdfunding a safe investment?

Real estate crowdfunding can be a safe investment, but it is essential to conduct thorough research and due diligence before investing.

2. How much money do I need to invest in real estate crowdfunding?

The amount required to invest in real estate crowdfunding varies depending on the platform and the specific project. Some platforms allow investments as low as $1,000.

3. Can I invest in real estate crowdfunding if I am not an accredited investor?

Yes, many real estate crowdfunding platforms are open to both accredited and non-accredited investors.

4. How long do I have to wait to see a return on my investment in real estate crowdfunding?

The timeline for returns on real estate crowdfunding investments can vary depending on the specific project. Some projects may offer returns within a few months, while others may take several years.

5. What happens if a real estate crowdfunding project fails?

If a real estate crowdfunding project fails, investors may lose some or all of their investment. It is important to understand the risks involved and diversify your investments to mitigate potential losses.

Real estate crowdfunding