Understanding High-Interest Credit Cards

What do you mean by high-interest credit cards?

High-interest credit cards are credit cards that come with a high annual percentage rate (APR). This means that if you carry a balance on the card from month to month, you will be charged a high amount of interest on that balance. These cards are typically targeted towards individuals with less-than-perfect credit scores or those who are new to credit.

How do high-interest credit cards work?

When you use a high-interest credit card to make a purchase, you are essentially borrowing money from the credit card company. If you pay off the balance in full by the due date, you will not be charged any interest. However, if you carry a balance, the credit card company will charge you interest on that balance, typically on a monthly basis.

What is known about high-interest credit cards?

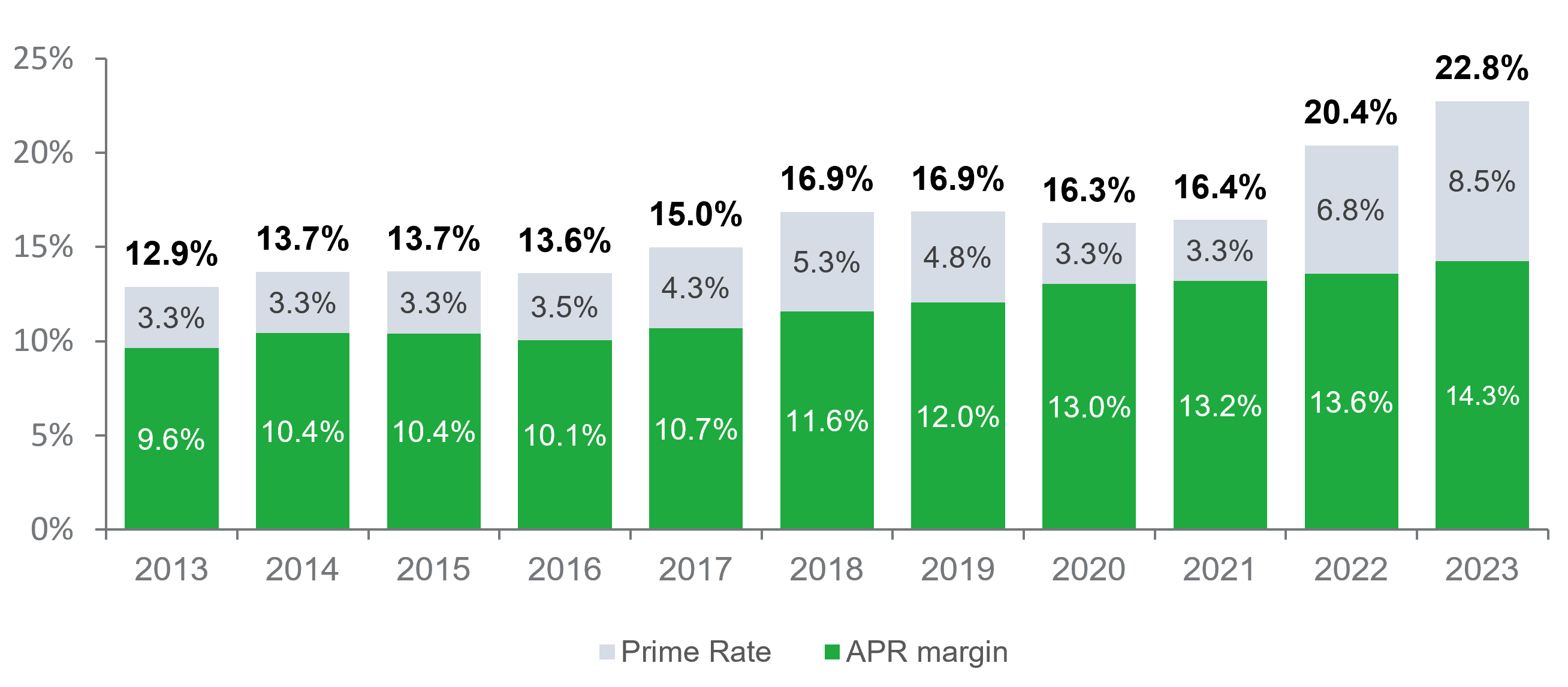

Image Source: consumerfinance.gov

High-interest credit cards are known for their steep interest rates, which can range from 15% to 25% or higher. This can make it difficult for cardholders to pay off their balances, especially if they only make the minimum monthly payment. Additionally, these cards often come with fees, such as annual fees, late fees, and over-limit fees, which can further add to the cost of using the card.

What is the solution to dealing with high-interest credit cards?

One solution to dealing with high-interest credit cards is to pay off the balance in full each month to avoid accruing interest. If you are unable to pay off the balance in full, consider transferring the balance to a card with a lower interest rate or taking out a personal loan to pay off the debt. You can also try negotiating with the credit card company to lower your interest rate or fees.

Information about high-interest credit cards

High-interest credit cards can be a useful financial tool for building credit, earning rewards, and providing convenience. However, it is important to be aware of the potential downsides, such as high interest rates and fees, and to use the card responsibly to avoid falling into debt. By understanding how high-interest credit cards work and being proactive about managing your finances, you can make the most of your credit card while minimizing the cost.

Conclusion

In conclusion, high-interest credit cards can be a double-edged sword. While they offer convenience and benefits, such as rewards and building credit, they also come with high interest rates and fees that can quickly add up. It is important to use high-interest credit cards responsibly, pay off the balance in full each month if possible, and explore alternative options if you find yourself struggling with debt. By staying informed and proactive, you can make the most of your credit card while avoiding financial pitfalls.

FAQs

1. How can I lower the interest rate on my high-interest credit card?

To lower the interest rate on your high-interest credit card, you can try negotiating with the credit card company. You can also consider transferring the balance to a card with a lower interest rate or taking out a personal loan to pay off the debt.

2. Is it worth using a high-interest credit card for rewards?

Using a high-interest credit card for rewards can be worth it if you are able to pay off the balance in full each month to avoid accruing interest. However, if you carry a balance, the cost of the interest may outweigh the benefits of the rewards.

3. How can I avoid falling into debt with a high-interest credit card?

To avoid falling into debt with a high-interest credit card, it is important to use the card responsibly, pay off the balance in full each month, and avoid making purchases that you cannot afford. It is also helpful to track your spending and create a budget to stay on top of your finances.

4. What should I do if I am struggling to pay off my high-interest credit card debt?

If you are struggling to pay off your high-interest credit card debt, consider reaching out to a credit counselor for assistance. They can help you create a repayment plan, negotiate with the credit card company, and provide guidance on managing your finances.

5. Are there any alternatives to using a high-interest credit card?

Yes, there are alternatives to using a high-interest credit card, such as using a debit card, prepaid card, or secured credit card. These options can help you avoid accruing debt and build your credit without the high cost of interest and fees.

High-interest credit cards