Home Loan Calculator: Your Ultimate Guide to Understanding and Using It

What do you mean by a Home Loan Calculator?

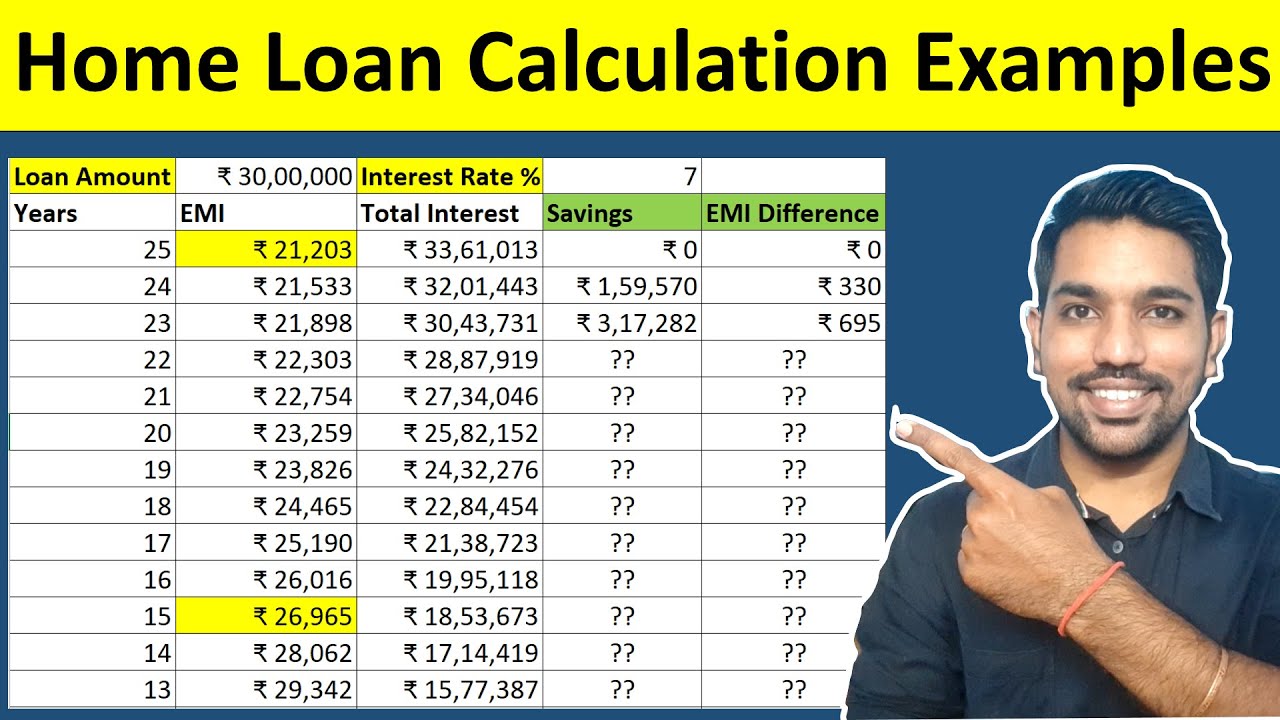

A home loan calculator is a tool that helps you calculate your monthly mortgage payments based on various factors such as the loan amount, interest rate, and loan term. It is a useful tool for anyone looking to buy a home or refinance their existing mortgage. By using a home loan calculator, you can get an estimate of how much your monthly payments will be, which can help you budget and plan accordingly.

How does a Home Loan Calculator work?

A home loan calculator works by taking the input of your loan amount, interest rate, loan term, and other relevant information and then using a mathematical formula to calculate your monthly mortgage payments. The calculator will also show you a breakdown of how much of your monthly payment goes towards the principal and interest, as well as the total amount of interest you will pay over the life of the loan.

What is known about Home Loan Calculators?

Image Source: ytimg.com

Home loan calculators are widely available online and can be found on most mortgage lender websites and financial websites. They are easy to use and provide quick and accurate results. Most home loan calculators allow you to adjust the inputs to see how different factors, such as the loan amount or interest rate, can affect your monthly payments. This can be helpful when comparing different loan options or trying to figure out how much you can afford to borrow.

Solution to using a Home Loan Calculator effectively

When using a home loan calculator, it’s important to input accurate information to get the most accurate results. Be sure to enter the correct loan amount, interest rate, loan term, and any additional fees or costs that may apply to your loan. You should also consider other factors that can affect your monthly payments, such as property taxes, homeowners insurance, and private mortgage insurance (PMI). By including all relevant information, you can get a more realistic estimate of your monthly mortgage payments.

Information on how to use a Home Loan Calculator

To use a home loan calculator, simply enter the required information into the designated fields on the calculator. This typically includes the loan amount, interest rate, loan term, and any additional costs associated with the loan. Once you have entered all the necessary information, the calculator will provide you with an estimate of your monthly mortgage payments. You can also adjust the inputs to see how changing factors can impact your payments.

Conclusion

In conclusion, a home loan calculator is a valuable tool for anyone looking to buy a home or refinance their mortgage. By using a home loan calculator, you can get an estimate of your monthly mortgage payments and better understand how different factors can affect your payments. This can help you make informed decisions when shopping for a mortgage and ensure that you choose a loan that meets your financial needs. With the information provided in this guide, you can confidently use a home loan calculator to plan for your future home purchase or refinance.

Frequently Asked Questions

1. How accurate are home loan calculators?

Home loan calculators are generally accurate as long as you input the correct information. They can provide you with a good estimate of your monthly mortgage payments based on the information you provide.

2. Can a home loan calculator help me determine how much I can afford to borrow?

Yes, a home loan calculator can help you determine how much you can afford to borrow based on your income, expenses, and other financial obligations. By adjusting the inputs, you can see how different loan amounts can impact your monthly payments.

3. Are home loan calculators free to use?

Yes, most home loan calculators are free to use and can be found on many mortgage lender websites and financial websites. You can use them as often as you like to compare different loan options and calculate your monthly payments.

4. Can a home loan calculator help me decide between a fixed-rate and adjustable-rate mortgage?

Yes, a home loan calculator can help you compare the monthly payments of a fixed-rate mortgage versus an adjustable-rate mortgage. By inputting the different interest rates and loan terms, you can see how each option affects your payments over time.

5. Is it necessary to use a home loan calculator when applying for a mortgage?

While it’s not required to use a home loan calculator when applying for a mortgage, it can be a helpful tool in understanding your financial obligations and planning for your future home purchase. By using a home loan calculator, you can make informed decisions and ensure that you choose a loan that fits your budget and financial goals.

Home loan calculator